8 reasons why retailers who sell to the middle class should be VERY worried

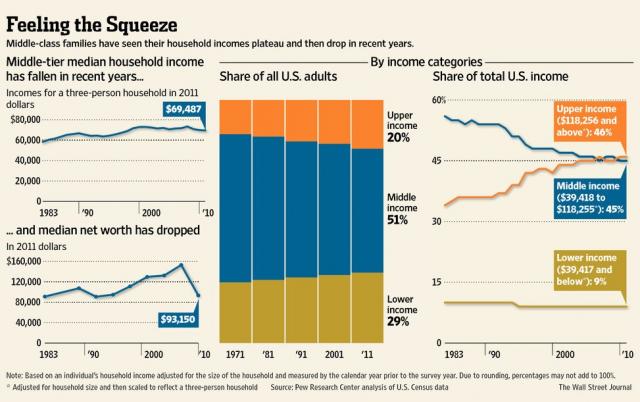

In the wake of the worst recession in 50 years, there’s little doubt that the American middle class (the 40% of households with annual incomes between $50,000 and $140,000 a year) is in distress. Even before the recession, incomes of American middle-class families weren’t keeping up with inflation, especially with the rising costs of what are considered the essential ingredients of middle-class life – college education, health care and housing.

In the wake of the worst recession in 50 years, there’s little doubt that the American middle class (the 40% of households with annual incomes between $50,000 and $140,000 a year) is in distress. Even before the recession, incomes of American middle-class families weren’t keeping up with inflation, especially with the rising costs of what are considered the essential ingredients of middle-class life – college education, health care and housing.

The slumping stock market and collapse in housing prices have also hit middle-class Americans, and as politicians and pundits in Washington continue to spar over whether economic inequality is in fact deepening, at our Charlotte marketing agency, the retail clients and consumer brands we support have already begun to adopt to the new marketplace reality: the customer base for businesses that appeal to the middle class is shrinking as the top tier pulls even further away.

Evidence for this massive economic restructuring? Here’s a few points to consider

- Since 2009, the year the recession ended, inflation-adjusted spending by the top 5% income bracket has risen 17 percent, compared with just 1 percent among the bottom 95 percent.

- About 90 percent of the overall increase in inflation-adjusted consumption between 2009 and 2012 was generated by the top 20 percent of households in terms of income, according to a new study by PricewaterhouseCoopers

- Sears and J. C. Penney, retailers whose wares are aimed squarely at middle-class Americans, are both in dire straits. Last month, Sears said it would shutter its flagship store on State Street in downtown Chicago, and J. C. Penney announced the closings of 33 stores and 2,000 layoffs.

- Shares of Sears and J. C. Penney have fallen more than 50 percent since the end of 2009, even as upper-end stores like Nordstrom and bargain-basement chains like Dollar Tree and Family Dollar Stores have more than doubled in value over the same period.

- Across the country, Olive Garden and Red Lobster restaurants are struggling, while fine-dining chains like Capital Grille are thriving.

- At General Electric, the increase in demand for high-end dishwashers and refrigerators now dwarfs sales growth of mass-market models.

- Foot traffic at mid-tier, casual dining properties like Red Lobster and Olive Garden has dropped in every quarter but one since 2005, according to John Glass, a restaurant industry analyst at Morgan Stanley, while at the Capital Grille, an upscale Darden chain where the average check per person is about $71, spending is up by an average of 5 percent annually over the last three years

- For the first time in 38 years, Proctor&Gamble has launched a new dish soap (“Gain”) in the U.S. at a bargain prices.

And P&G isn’t the only company adjusting its business to serve a consumer market that’s bifurcating into high and low ends while eroding in the middle A wide swath of American companies has begun to alter the way they research, develop and market their products, and at Charlotte marketing agencies like ours, it’s clear that middle-market shoppers are trading down to lower-priced goods – widening the pools of have and have-not consumers at the expense of the middle.